Unlocking opportunities with crypto payments

A new digital age has emerged, and decentralization, privacy, and self-sovereignty play a crucial role in new business models.

Today society values individual choice and control over finance and personal data more than ever before; therefore, decentralized technologies such as digital currencies have gained positive momentum.

Since the release of the Bitcoin protocol in 2009, cryptocurrencies have experienced a lot of growth. Entrepreneurs, institutions, politicians, and governments are adopting digital currencies to store or exchange value, and in June 2021, El Salvador became the first country to recognize Bitcoin as legal tender.

Bitcoin has grown to become the sixth-largest currency in circulation, thus becoming one of the most significant contributors to the global money supply.

Moreover, cryptocurrencies have proven to be a reliable store of value, unit of account, and a convenient way to transfer value.

This article will focus on the latter use case and talk about the benefits of cryptocurrencies as a means of exchange and how businesses and individuals can unlock opportunities with crypto payments.

Payments in the traditional financial industry

Over time, the digitized economy has increased, accelerated by the internet and mobile phones. More recently, the COVID-19 pandemic prevention measures have brought greater adoption for online retail.

Moreover, over the last decade, we have seen a lot of innovation around financial services. Neo banks and fintech have emerged across the globe and developed solutions to digitize and improve the user experience of banking services and payment mechanisms.

However, all this innovation has failed to change our economic sector fundamentally. The traditional financial and banking industry remains outdated and has many weaknesses that negatively impact domestic and international payments.

The introduction of Central Bank Digital Currencies shows the recognition from governments that the traditional financial system needs a fundamental change to meet the world’s necessities.

So, let us elaborate on what some of those weaknesses are.

Expensive and slow international payments

International payments are costly, inefficient, and there’s a lot of friction involved. Arguably, half the problem is that every cross-border payment requires the conversion of foreign currencies, which involves different intermediaries, markups, and diverse regulations.

Just how many conversions does an international transaction require? An article published by Coindesk shows that most international payments need two or more currency conversions.

These inefficiencies are particularly inconvenient for economies dependent on remittance payments and who, according to the world bank, are losing at least 6.8% of their money just on fees.

Tech companies, such as Venmo and Paypal, have developed peer-to-peer payment solutions that reduce intermediaries and improve the user experience. However, these solutions are still dependent on banks to settle funds, and in most cases, users still have to wait from 1 to 5 labor days to access them.

Moreover, international payments are commonly exchanged into local currencies, causing money loss caused by the conversion rate.

Financial repression

In the traditional financial system, each government has sovereignty over its local currency. Therefore when an economy is experiencing a crisis, the government can apply controls on how much local money can be exchanged and ban foreign currencies from preventing speculation against its local currency.

In many cases, these currency controls lead to financial repressions, such as frozen bank accounts, payment surveillance, and the banning of fintech apps.

Take Venezuela as an example. Venezuela’s economy has been experiencing severe hyper-inflation since 2016; moreover, the country is under an authoritarian regime.

The financial repression imposed by their government prevents their citizens from preserving the value of their money, hedge against inflation, and participate in the global economy.

Argentina is another example of a jurisdiction with currency controls to mitigate its financial crisis.

Financial repression exists within the traditional financial system, which means that not all individuals don’t have complete control over their money in the current structure.

Financial exclusion

Access to financial services is critical to combating global poverty by providing an alternative way to save money, request credit, and send or receive remittances. According to the world bank, Globally, 1.7 billion adults remain unbanked.

The leading causes of the unbanked population are still unclear. However, research done by the world bank suggests that some of the reasons why individuals remain unbanked are:

They don’t trust financial institutions

They don’t perceive the need to have a bank account

Lack of wealth or steady income

Need of proper documentation

Lack of education

The crypto payment solution

Most of the challenges listed above demand a fundamental change in the financial system, and cryptocurrencies have proven their ability to mitigate the weaknesses of the traditional financial system. We will explain in detail in the following section.

Crypto payments should be seen as a complementing payment mechanism that expands individuals’ capabilities and not necessarily substitutes existing payment methods.

EMV solutions such as MasterCard and online processor companies such as PayPal have recently started to support cryptocurrencies, showing the high demand for a solution to access digital assets and spend them.

So, what are the benefits of crypto payments?

Fast and cheap payments

Cryptocurrencies function in a peer-to-peer network wherein no single intermediary must custody accounts to process transactions. An individual can directly pay another individual digitally without the need for an intermediary to record the exchange.

Moreover, cryptocurrencies are borderless; this means that they are not connected to any jurisdiction.

Therefore you can send or receive an international payment faster and pay less commission with a blockchain network than through financial institutions.

To illustrate this, in 2020, Bitfinex Made a $1.1 Billion BTC transaction for only $0.68.

Censorship-resistant

Because a permissionless, public blockchain network does not need a central authority to act as an intermediary, users have complete choice and control over their wealth.

This has a positive impact, especially for people who live in economies with monetary restrictions such as Argentina and Venezuela precisely. For example, merchants can receive payments for their products and services in a currency that allows them to preserve the value of their money and therefore hedge against inflation.

Financial inclusion

Neobanks and fintech have made it their mission to bank the underbanked. However, most of their innovation remains focused on the account and not on the system. Crypto payments can improve financial inclusion mainly in two ways.

Reducing Costs

Crypto payments lower the system costs by reducing the number of intermediaries, which is very helpful for the underserved market, especially for individuals who depend on remittances.

Access

Everyone can access all cryptocurrencies and send or receive payments from anyone regardless of where they are in the world. This accessibility can help marginalized communities to participate in the global economy and join international trade.

Unlock opportunities with Bitfinex Pay

Society’s globalized and digital lifestyle begs for safer, faster, and cheaper payment mechanisms, and Bitfinex Pay is the perfect getaway to the crypto payments world.

Bitfinex Pay is a widget that allows users and merchants to pay and accept crypto payments seamlessly in Bitcoin, Lightning Network BTC, Ethereum, and Tether tokens directly into your Bitfinex account and with no additional fees.

What are the benefits of using Bitfinex Pay?

Top-notch technology. Bitfinex pay is backed by Bitfinex’s top-notch technology and experience as one of the longest-running crypto exchanges.

Easy to use. Using cryptocurrencies can be very complicated at first. However, Bitfinex Pay is very straightforward; you don’t need to be blockchain literate to integrate it into your online shop and start accepting crypto payments.

Direct crypto payments. Bitfinex Pay expands the possibilities for shoppers and merchants. Individuals receiving money in cryptocurrencies can spend their funds in the same currency without the need to convert back and forth between crypto and government-issued currencies to make purchases.

How does it work?

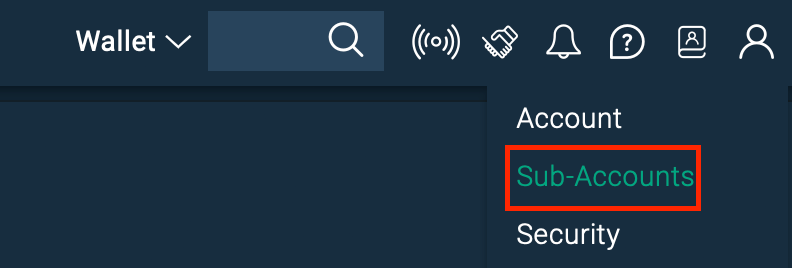

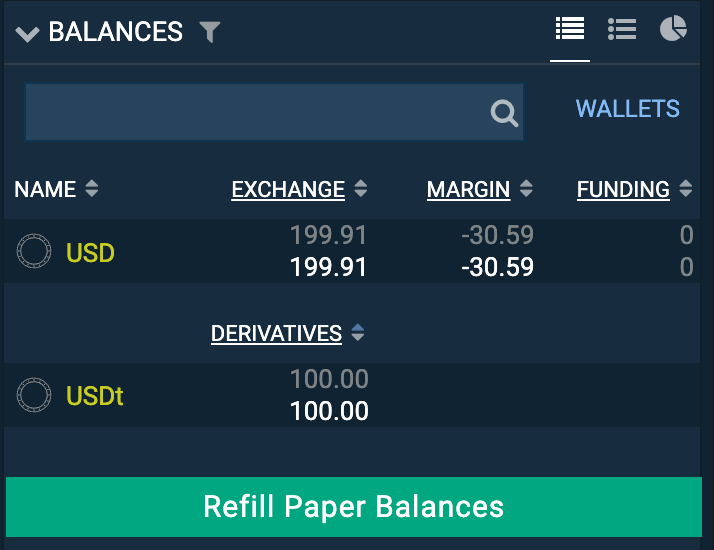

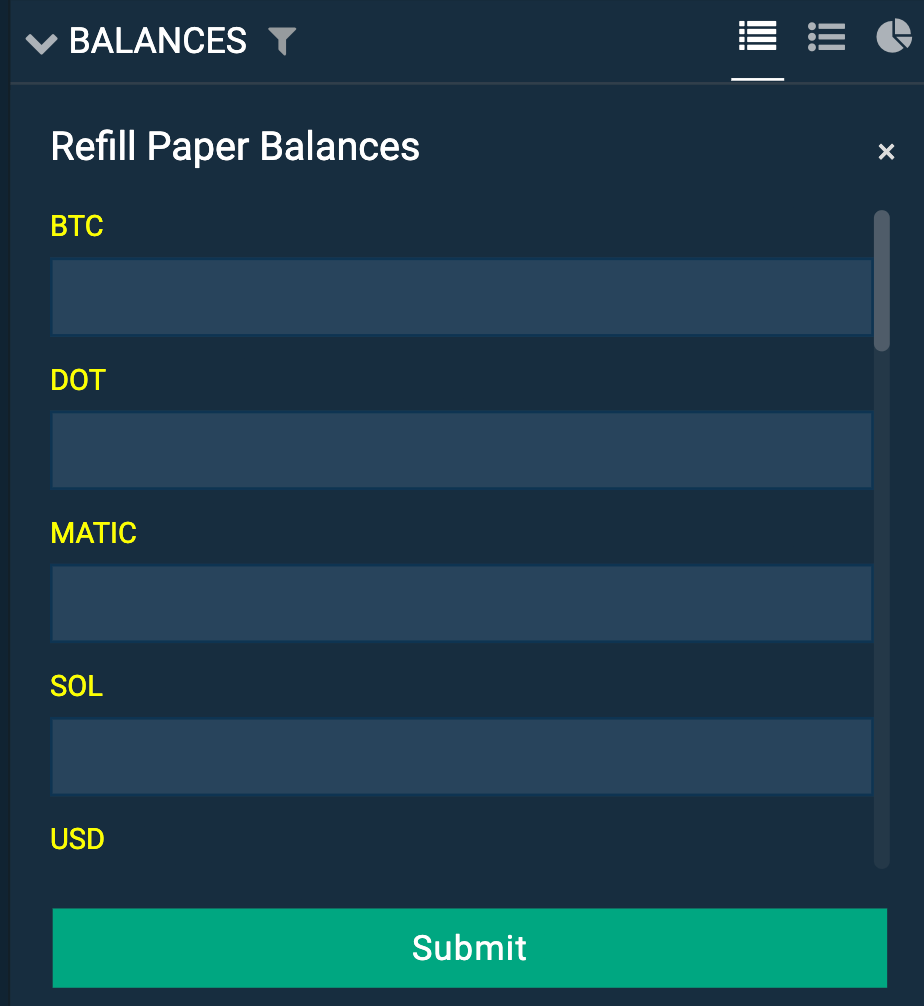

First of all, you need to get set up. This process consists in signing up on Bitfinex, applying for merchant verification, and embedding Bitfinex Pay on your check-out page. You can find all the steps in more detail here.

Once you have successfully activated your merchant account, this is the journey that your customers will follow.

Taxation

Virtual currency transactions are now taxable in most jurisdictions. Taxpayers who do not correctly report their virtual currency transactions can be audited for those transactions and, when appropriate, be held liable for penalties and interest. The taxation regime varies across countries and can involve complex rules.

Over the years, Bitfinex has developed a reporting tool to help users keep track of their transactions on our platform. The tool is available here: Bitfinex Reporting App.When filing your tax reports, please ensure to seek independent legal advice. The app is intended for convenience purposes only and shall by no means constitute legal or tax advice.

For example, the app provides users access to their overall balance (taking into account all wallets’ balances on Bitfinex and trading positions, profit and/or loss, and other features.

Although the first bitcoin block was mined way back in January 2009, cryptocurrencies are still in their infancy, and it is evident that there is still much work to be done, especially in regulatory areas. Therefore, we highly recommend you consult a tax professional to help you understand how you should report cryptocurrency payments in your country.

Despite all of the regulatory gaps, something irrefutable is that as the world shifts towards a cashless economy, crypto is a viable addition to existing payment systems, so don’t wait any longer and get started now with Bitfinex Pay.